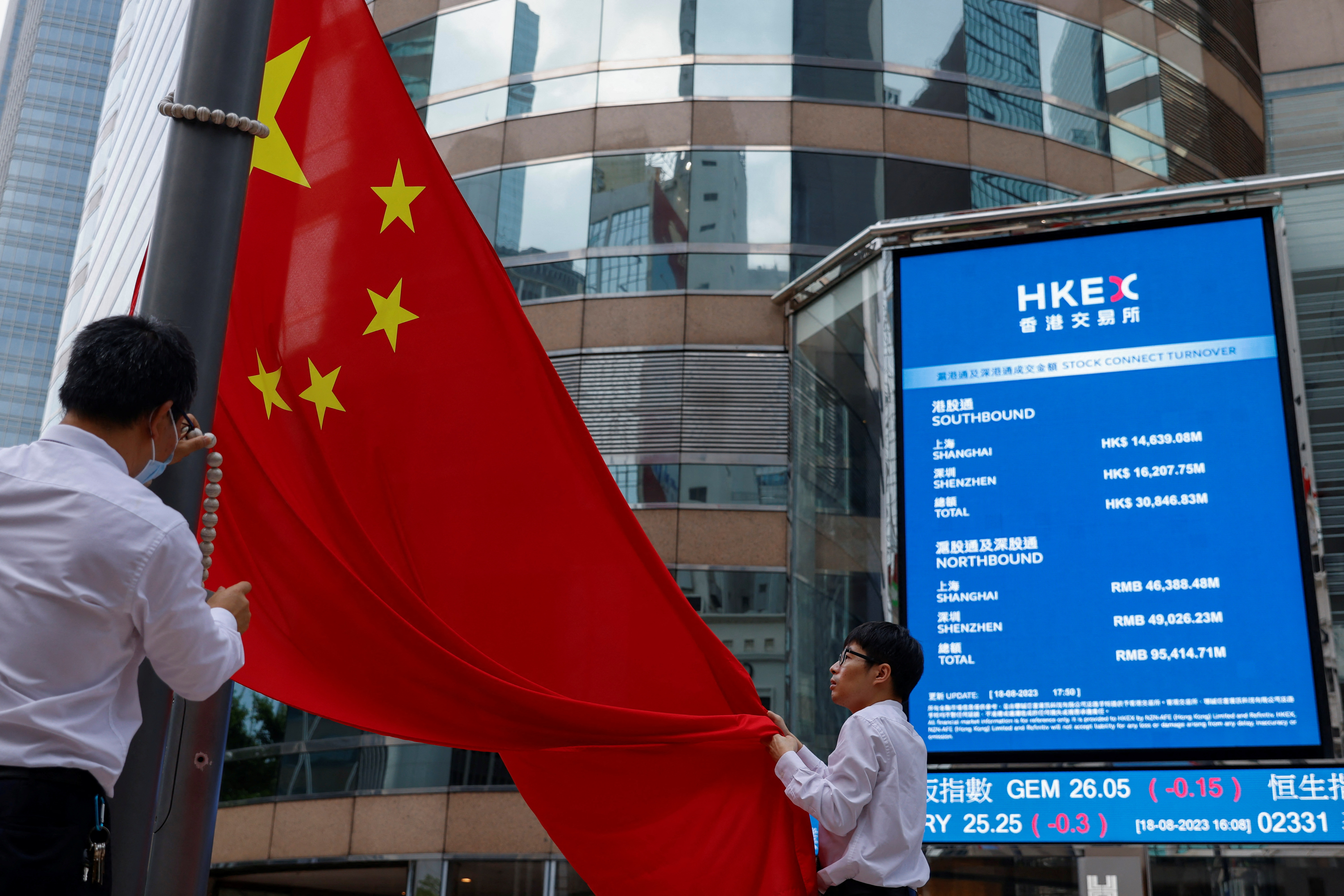

Workers lower the Chinese national flag in front of screens showing index and stock prices outside Exchange Square on August 18, 2023 in Hong Kong, China. REUTERS/Tyrone Siu/File Photo Get license rights

SINGAPORE, Oct 24 (Reuters) – Asian shares edged higher on Tuesday after November 2022, while the dollar eased as traders shunned bets ahead of economic data expected to provide clues on the U.S. Federal Reserve’s next steps. .

Oil prices recovered some of the previous day’s losses as markets worried that the Israel-Hamas war could escalate into a wider conflict in the oil exporting region.

MSCI’s broadest index of Asia-Pacific shares outside Japan ( .MIAPJ0000PUS ) pared losses by 0.41% to trade at 476.72, the lowest since November 2022 at 472.73.

Down 3% for the month, the index is set in the red for a third consecutive month. Japan’s Nikkei (.N225) rose 0.21% after an earlier decline of 1.4%.

Futures showed European shares were poised to open lower, with Eurostoxx 50 futures down 0.10%, German DAX futures down 0.11% and FTSE futures down 0.16%.

“The threat of inflation grows more looming, especially given the recent sharp rise in oil prices,” said Gary Dugan, chief investment officer at Dalma Capital.

“If oil prices remain at this level throughout 2023 and 2024, this could inject another burst of inflation into the global economy.”

Investor attention this week will be split between earnings and economic data numbers from high-profile companies such as Microsoft ( MSFT.O ), Facebook parent Meta Platforms ( META.O ) and Amazon ( AMZN.O ). Ahead of the central bank meeting from October 31 to November 1.

The US Commerce Department will report third-quarter gross domestic product on Thursday, while the US Federal Reserve’s preferred inflation gauge, the Personal Consumption Expenditure (PCE), report will be released on Friday.

But before that, investors will look to flash purchasing managers’ index (PMI) data from Britain, France, the euro zone and the US later on Tuesday.

The data barrage ahead of central bank meetings in the next two weeks, with the European Central Bank expected to meet on Thursday and keep rates steady, a Reuters poll of 85 analysts showed.

“It’s already reasonable to suggest the ECB won’t leave rates this week, with October’s flash PMIs helping to underline how weak the European economy is,” said Michael Hewson, chief market analyst at CMC Markets in London.

China shares were under pressure, with Hong Kong’s Hang Seng Index (.HSI) down 0.68%, although the Shanghai Composite Index (.SSEC) rose 0.32%.

China’s blue-chip CSI300 index (.CSI300) closed at its lowest level in 4-1/2 years on Monday.

Investor confidence remained weak after state fund Central Huijin bought exchange-traded funds to boost the flagging market.

The yield on the benchmark 10-year U.S. Treasury note was up 0.80 basis points at 4.846% in Asian hours on Tuesday, briefly rising above 5.0% following the previous day’s sharp decline.

The rise in yields on the 10-year Treasury note, considered a safe haven in times of economic uncertainty and a benchmark for global borrowing costs, was partly driven by investors pricing in strong U.S. growth.

On Monday, billionaire investor Bill Ackman said he had hidden his previous challenges against Treasuries in anticipation that the Israel-Hamas war would push more investor dollars toward U.S. Treasuries.

In currency markets, the dollar was softer against a basket of currencies after falling 0.5% on Monday. The dollar index was down 0.076% at 105.52.

The yen remained under pressure, but got some relief from the dollar’s retreat.

The Japanese currency traded at 149.74 to the dollar on both Friday and Monday, after reaching the key level of 150 on Friday and Monday, which markets see as having the potential to trigger intervention by authorities to prop up the currency.

Among cryptocurrencies, bitcoin made a comeback, with speculation about the possibility of an exchange-traded fund fueling excitement and prompting short sellers to exit positions.

The world’s largest cryptocurrency traded as high as $35,198, hitting an 18-month high, before easing to $34,427, up 4% on the day.

In commodities, US West Texas Intermediate crude futures rose 0.32% to $85.76 a barrel, while Brent rose 0.33% to $90.13.

Spot gold rose 0.2% to $1,975.49 an ounce.

Editing by Jamie Freed and Clarence Fernandez

Our Standards: Thomson Reuters Trust Principles.